Consuming lunch the opposite day with my co-workers at our bungalow-turned-home-office, I obtained interrupted by a telephone name from somebody claiming to be from my TV service firm.

Uninterested in the scammers, I requested the man on the road in regards to the climate there after which advised him how we might repair his air conditioner if he put $500 on a present card for Residence Depot after which advised him how he’d have to learn me these numbers.

“Come on,” I egged him on, “you know the way to do that. You have been telling folks how to do that for years.”

Yeah, the pandemic can drive you a bit excessive. My son, the accountant, and my husband, the editor, simply shook their heads. My son later advised me: “Nice mother, now the man’s going to get again at us by submitting a faux tax return.”

And so it has come to this: We’re both getting scammed by these guys or getting labored up when these guys hold calling. And sure, we marvel what they could do subsequent.

Now that it’s tax season, scammers will use one scheme after one other to craft stimulus scams, file phony tax returns to steal tax refund money or stage some drama to scare us into handing over our Social Safety numbers, checking account numbers and money.

The most effective recommendation stays to easily dangle up the telephone on scammers, and do not interact with their texts.

The three rounds of stimulus funds supply customers monetary aid in the course of the pandemic, however additionally they give scammers one other storyline.

Amy Nofziger, director of sufferer help for the AARP Fraud Watch Community, stated one shopper was contacted by somebody supposedly from USATaxHelp12@gmail.com who reportedly had a strategy to expedite a stimulus fee.

The buyer sadly signed an digital doc, and now the scammers have his e-signature. Be cautious in the event you obtain an electronic mail stating that you’ve paperwork to signal. Should you haven’t requested any paperwork, it’s seemingly a phishing assault.

One other clue: A legit enterprise hardly ever makes use of a web-based Gmail or Yahoo account.

The IRS is not sending texts about stimulus cash

Sarah Kull, particular agent answerable for the Inside Income Service Felony Investigation Division of the Detroit area workplace, warns of an uptick in Financial Affect Fee schemes, together with textual content messages that ask taxpayers to reveal checking account data.

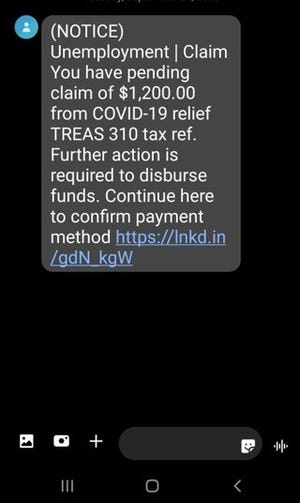

One textual content despatched by scammers famous: “You may have a pending declare of $1,200.00 from COVID-19 aid TREAS 310 tax ref.”

Once more, texts aren’t a part of actual stimulus rollout packages. But somebody who’s uncertain about how or once they would possibly obtain a stimulus fee would possibly wrongly imagine the textual content is legit.

The phony textual content signifies: “Additional motion is required to just accept this fee. … Proceed right here to just accept this fee …”

Should you pressed the hyperlink, you ended up at a phishing net deal with. One faux hyperlink, in response to an IRS warning in November, took folks to a faux web site that appears just like the Get My Fee web site at IRS.gov.

If folks go to the faux web site and entered their private and monetary account data, the IRS warned, the scammers might acquire that information to make use of in ID theft-related crimes.

Extra:Social Safety scammers now textual content photos of phony badges

Extra:Not as many Individuals eligible for third stimulus verify: Here is what it is advisable to know

The IRS stated individuals who obtain this textual content rip-off ought to ship a screenshot in an electronic mail to phishing@irs.gov. You’d embody if you obtained the textual content message, the telephone quantity it supposedly got here from, and the telephone quantity that obtained the textual content.

Rip-off warning: The IRS is not going to ship a textual content regarding a stimulus fee or a textual content asking you to share your checking account data.

Do not pitch an odd 1099

Many retirees and others had been shocked once they obtained a 1099-G within the mail to report unemployment advantages on their tax returns this yr.

One caller to the AARP Fraud Watch Community Helpline famous that the 1099-G that he obtained indicated he wanted to report $2,400 in jobless advantages, Nofziger stated. However the man had been retired for 17 years and did not file for unemployment advantages in 2020. As an alternative, somebody used his private data to file a declare.

“Lots of these victims had been unaware they had been victims till the 1099-G got here out,” she stated.

“It is very jarring for folks to obtain this type.”

You do not wish to ignore a 1099-G. Contact the state unemployment workplace to report the fraud and get a corrected 1099-G that exhibits you didn’t get any advantages.

The IRS states that victims of ID theft mustn’t report earnings that they did not obtain even when they haven’t but been capable of get a corrected 1099-G earlier than submitting their tax returns.

Extra:Properly-known Michigan lawyer’s ID stolen in Ohio unemployment rip-off

Extra:Faux jobless claims now set off tax troubles for victims

Do not decide a scammer to do your taxes

Sadly, unhealthy actors pop up throughout tax season, possibly somebody you have met by a pal of a pal, pretending to give you an awesome deal or promising to get you an additional massive tax refund.

Nofziger famous {that a} man reported in early March a few tax preparer discovered by Fb.

After having a tax return accomplished, the tax preparer stated the refund was $1,000 lower than the tax refund listed on their 1040. One way or the other, the charges are a lot greater than initially quoted. The tax preparer needs a refund deposited into one in every of her accounts after which plans to chop a verify and ship the taxpayers their refund.

No shock, the taxpayers are actually having bother reaching this particular person and getting a standing on their return.

“They seemed up the routing variety of the account that it’s alleged to be deposited into and stated it seems to be like some form of wire switch routing quantity,” Nofziger stated.

The IRS says that regardless that most tax return preparers present trustworthy service, some trigger nice hurt by fraud, identification theft and different scams yearly.

Dishonest preparers can steal your private ID data, possibly Social Safety numbers in your youngsters; and a few would possibly even steal a significant a part of your tax refund.

One pink flag: A tax preparer who does not have to see a W-2 or different paperwork. You don’t need a tax preparer to invent earnings so you’ll be able to qualify for tax credit.

By no means signal a clean tax return or one which’s not accomplished. Evaluation the routing and checking account quantity on the finished return. Try to be getting the tax refund, not the tax preparer.

The IRS warns: “Ghost preparers do not signal the tax returns they put together. They might print the tax return and inform the taxpayer to signal and mail it to the IRS.”

Paid preparers are required to signal and embody their preparer tax identification quantity on the return. “Not signing a return is a pink flag that the paid preparer could also be trying to make a quick buck by promising a giant refund or charging charges based mostly on the scale of the refund,” the IRS warns.

Additionally the IRS warns: “Don’t assume web commercials, pop-up adverts or e-mails are from respected corporations.”

Volunteers from tax preparation packages will help many individuals. The AARP Basis Tax-Aide program, for instance, presents in-person and digital tax help to anybody freed from cost with a particular concentrate on taxpayers who’re over 50 or have low to reasonable earnings. This yr, tax help is offered by appointment solely. See aarpfoundation.org/taxaide.

Or see IRS.gov and the record of Volunteer Earnings Tax Help websites for individuals who qualify based mostly on earnings; some packages are making ready returns off-site this yr as a result of COVID-19.

Free tax assist is offered for individuals who usually make $57,000 or much less, these with disabilities and taxpayers with restricted English.

Impersonation scams proceed

Do not react to a letter or a telephone name out of the blue that appears official as a result of these reaching out to you understand you owe again taxes. Some data may be pulled by scammers from public databases or elsewhere.

Keep in mind, ID theft revolves round making issues sound credible, so the crooks typically take time to do some analysis upfront to sound like the true deal.

One essential level to recollect: The IRS will not be going to name you about again taxes that you could be owe with out sending you a written discover first. Should you’re getting a name out of the blue, it is an imposter.

“The IRS doesn’t provoke contact with taxpayers by electronic mail, textual content messages or social media channels to request private or monetary data,” in response to a brand new IRS alert.

“Usually, the IRS first mails a paper invoice to an individual who owes taxes,” the IRS acknowledged. “In some particular conditions, the IRS will name or come to a house or enterprise.”

The Michigan Division of Treasury warned in January that customers in northern Michigan had been receiving threatening tax assortment letters from scammers. The letters included this scare tactic: “Name Instantly to Forestall Property Loss.”

If the state tax debt wasn’t settled, the letter written by a scammer warned, the taxpayer’s property and Social Safety advantages might be seized.

“The piece of correspondence seems credible to the taxpayer as a result of it makes use of particular private info about their actual excellent tax debt that’s pulled straight from publicly accessible data,” in response to the state treasury.

“The scammer’s letter makes an attempt to lure the taxpayer right into a scenario the place they may make a fee to a felony.”

Do not rush to pay anybody. You do not wish to assume you are clearing up a monetary mess solely to seek out out that you just handed over your hard-earned money to a criminal.

ContactSusan Tompor via stompor@freepress.com. Observe her on Twitter@tompor. To subscribe, please go to freep.com/specialoffer. Read extra on enterprise and join our enterprise e-newsletter.

The post Stimulus, tax scams are everywhere: What to watch for appeared first on Correct Success.

source https://correctsuccess.com/finance/stimulus-tax-scams-are-everywhere-what-to-watch-for/