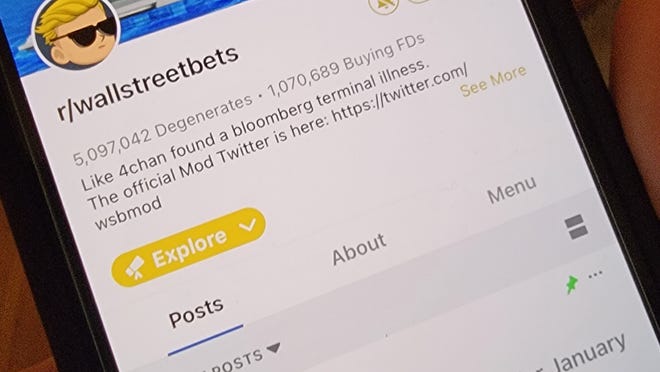

The very first thing you notice on the house web page of subreddit r/WallStreetBets is a banner that includes a cartoon character in a go well with using on a yacht, with a avenue signal studying “Wall St” sitting on prime.

Whereas the Reddit neighborhood won’t look critical, its collaborative investing technique has captured the eye of Wall Avenue.

The subreddit has performed a key position within the shares of struggling video retailer GameStop surging by greater than 1,000% at instances this week.

The Reddit revolt centered on a method referred to as brief promoting, the place hedge funds earn a living by betting that share costs will fall.These buyers earn by figuring out a inventory anticipated to drop in worth, then borrowing shares from one other investor and instantly promoting them. By the point they must return the shares, they hope they’re in a position to purchase the inventory at a cheaper price, to revenuefrom the distinction.

On-line buying and selling:Robinhood restricts trades on GameStop, AMC inventory amid volatility

Robinhood tutorial:Apps like Robinhood make it straightforward for newcomers. Here is how I began.

On this case, smaller buyers banded collectively by way of Reddit to assist drive GameStop shares larger. The consequence might harm hedge funds that had deliberate on shares falling, as a substitute, they’ve to purchase again the inventory at a lot larger costs.

“It’s fairly exceptional and myself, my colleagues {and professional} merchants, we’ve by no means seen something prefer it,” stated Matthew Lyle, an affiliate professor at Northwestern College’s Kellogg Faculty of Administration. “There’s some dangers for some individuals, that’s for certain, however it’s simply very curious this has been pulled off.”

Jaime Rogozinski, who began the subreddit 9 years in the past, informed USA TODAY, “It is completely fascinating to have this collective group of folks that have managed to seek out group out of chaos.”

How WallStreetBets began

The WallStreetBets subreddit began in 2012 by Rogozinski whereas he was working at a big multinational financial institution in Washington, D.C.

Rogozinski stated he was taking a look at a “high-risk high-return” technique of utilizing the market versus having a long-term, diversified portfolio.

“I had private curiosity in it, and once I went to be taught extra about it and was unable to seek out anywhere on-line that needed to do what I used to be seeking to do and be taught, I simply created this discussion board and attracted folks that had been in my similar mindset,” stated Rogozinski throughout an interview with USA TODAY.

Curiosity in WallStreetBets grew as extra individuals needed to money in in the marketplace in the identical method. It additionally coincided with the rise in particular person investing sparked by apps together with Robinhood and Acorns, which permit individuals to take a position smaller quantities of cash.

“It is a mixture between individuals discovering out about this – and it turns on the market had been numerous individuals with that very same mindset – in addition to an trade that allowed easy accessibility to this sort of exercise,” stated Rogozinski, who has not been concerned with the subreddit since April of final 12 months.

The usage of apps like Robinhood has surged throughout GameStop’s wild inventory trip. On Apple’s App Retailer, Robinhood is presently the most well-liked free app, whereas one other buying and selling app referred to as WeBull is fifth, forward of widespread companies like Fb and Instagram.

As of Thursday morning, WallStreetBets has 4.9 million followers – with greater than 1 million becoming a member of over the past day or so – lots of whom have seen this effort as a technique to push again towards the giants of Wall Avenue.

Who belongs to WallStreetBets?

There’s not one typical profile of a member of the discussion board.

“WallStreetBets is known as a unfastened affiliation of merchants,” Derek Horstmeyer, an affiliate finance professor at George Mason College’s Faculty of Enterprise. “They usually take immediately completely different positions from one another – some lengthy a inventory and a few brief. It simply so occurred this time all of them went the identical path on GME (GameStop).”

However do not confuse the Reddit buying and selling group with amateurs.

“These are usually not basement-dweller trolls, these are sensible individuals. Sure, they’ve their very own vernacular that could be completely different than you might be used to listening to,” Dan McComas, former senior vice chairman for product at Reddit, informed CNBC Thursday.

What’s the Reddit group’s mission?

McComas, who’s now the vice chairman of product for video firm Metallic.television, informed CNBC that he’s a member of the WallStreetBets discussion board. “With a motion behind them and their neighborhood rising, they’re beginning to unfold out and have a look at organizations like (CNBC and) like different individuals concerned within the establishment of inventory market buying and selling and realizing that they’ve energy,” he stated.

With this “large inflow of individuals rallying round their mission,” McComas stated, and many “truly keen to place cash behind their phrases, I feel it is sort of a excellent storm of all issues coming collectively.”

To succeed, the group has to rely upon fellow discussion board members who they probably do not know, Lyle stated. Some might really feel the urge to promote shares after they’ve bought a hefty revenue. “To carry this group collectively or at the least get sufficient new individuals coming to maintain it going can also be exceptional,” he stated.

This “gutsy” effort seems aimed to “screw the hedge funds, for lack of a greater phrase,” says Lyle.

“Individuals are rooting for wsb as a result of it is not an enormous establishment, group, or perhaps a hive thoughts,” reads a tweet from the subreddit’s Twitter account. “It is a gathering place of tens of millions of distinctive people who’re bored with being run over by the large guys and are every preventing again in their very own method.”

However the repercussions for the market stay to be seen.

“This can positively filter out all brief sellers of thinly traded shares for some time,” Horstmeyer stated. “And in all, that is actually dangerous for U.S. markets since it’ll simply make our markets much less environment friendly – brief sellers are wanted to right costs and that is getting all brief sellers out of the market.”

Because the inventory fell under $200 on Thursday, Lyle, the Northwestern professor, stated he thought the tip is likely to be occurring. However shares rose again as much as $250 – and had been at $215 noon.

“My perception is that that is going to finish with a fairly sharp value correction,” he stated. “I’m usually mistaken, however that’s my perception. I feel it’s got to finish someday quickly, perhaps within the subsequent week or so. However I simply don’t know when.”

Whereas these supporting the Reddit group’s mission have taken to Twitter with the hashtag #HoldTheLine, there’s an inevitable ending when the music stops. That is as a result of the technique the group is utilizing to extend inventory costs is akin to a pyramid scheme, says Michael Pachter, managing director of fairness analysis at Wedbush Securities.

“There received’t be elementary buyers shopping for the inventory at $200 after which $300 and $400,” he stated. “The one method the inventory goes larger is that if the Reddit Military believes it could possibly sustain squeezing the shorts and if the shorts maintain shorting. … that continued share value appreciation requires extra buyers to return in at ever larger costs.”

Comply with Brett Molina and Mike Snider on Twitter.

The post GameStop stock caught up in Reddit group’s effort to hit hedge funds appeared first on Correct Success.

source https://correctsuccess.com/finance/gamestop-stock-caught-up-in-reddit-groups-effort-to-hit-hedge-funds/

No comments:

Post a Comment